Step one is to check your credit rating. Once you understand your credit score score, you could look for lenders who work with borrowers with the sort of credit history score you have. For example, some lenders don't consider borrowers with a rating of a lot less than 630. Other lenders will operate with borrowers who may have a minimal credit history score of 550.

By using an online lender to submit an application for $3000 loans, you will be providing your self the applications necessary to locate the greatest quick loan alternatives Which may be less costly than other options offered. Using the expert services of pawn retailers, automobile title loan facilities, and/or PayDay loan providers, may be a speedy alternative, on the other hand, it may possibly pose an unneeded risk to dropping a car or truck or useful objects.

Considering the fact that you are attempting to protected a small loan amount of money with bad credit history, it could be simpler to qualify. Even so, it is possible to still expect to pay for a higher interest rate. In addition, a lender may possibly only offer a brief repayment phrase.

With regards to getting a $three,000 personal loan you have a couple options. You can visit your neighborhood financial institution or credit score union or use a web based lender. Numerous on-line lenders offer very aggressive charges when compared with financial institutions and credit history unions. Also, on the web lenders can have a lot quicker approval and funding procedures.

After reviewing the above mentioned functions, we sorted our tips by very best for Over-all funding requires, rapid funding, lessen curiosity premiums and versatile terms.

*You have to full a loan application and carry on to meet any conditions used to select you for just a loan offer you. Not all applicants are authorized. Loan acceptance and genuine loan terms depend on applicant's point out of residence and skill to satisfy OneMain Economical credit rating specifications for instance a dependable credit heritage, adequate profits following every month bills, and when applicable, availability of qualified collateral.

Can you can get a $three,000 loan without credit rating? $3000 loans could possibly be accessible to individuals with no credit or bad credit, these solutions possible will feature better interest rates, service fees, or maybe the need to provide collateral for getting permitted.

If you want a fast personal loan, think about using an on-line lender. Most on the net lenders Have a very quickly software and acceptance course of action. Some on the web lenders could even provide exact day funding. Verify features nowadays!

Before starting the method, pause to get a second to evaluate your credit rating report and score. If possible, boost your score or handle any concerns to increase your potential for qualifying.

. By submitting your data, you conform to obtain emails from Motor by Moneylion. Pick does not Management and isn't accountable for 3rd party insurance policies or practices, nor does Decide on have usage of any information you give.

Lenders are normally hesitant to lend big quantities of revenue without any assurance. Secured loans decrease the chance of the borrower defaulting because they chance getting rid of no matter what asset they place up as collateral.

Who's this for? Prosper permits co-borrowers to submit a joint application: This may surely be a large draw for a few borrowers when you think about that this isn't readily available for all loans.

Moreover, you might want to present the Close friend or family member an incentive for helping. This could turn into a win-win for each of you.

A secured loan implies that the borrower has place up some asset as a kind of collateral right before remaining granted a loan. The lender is issued a lien, which happens to be a proper to possession of assets more info belonging to a different individual until eventually a personal debt is paid. To put it differently, defaulting over a secured loan will provide the loan issuer the lawful power to seize the asset which was set up as collateral.

Romeo Miller Then & Now!

Romeo Miller Then & Now! Katie Holmes Then & Now!

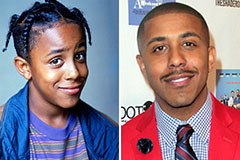

Katie Holmes Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Shane West Then & Now!

Shane West Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now!